↓ old Kitten.finance ↓

Advancing DeFi.

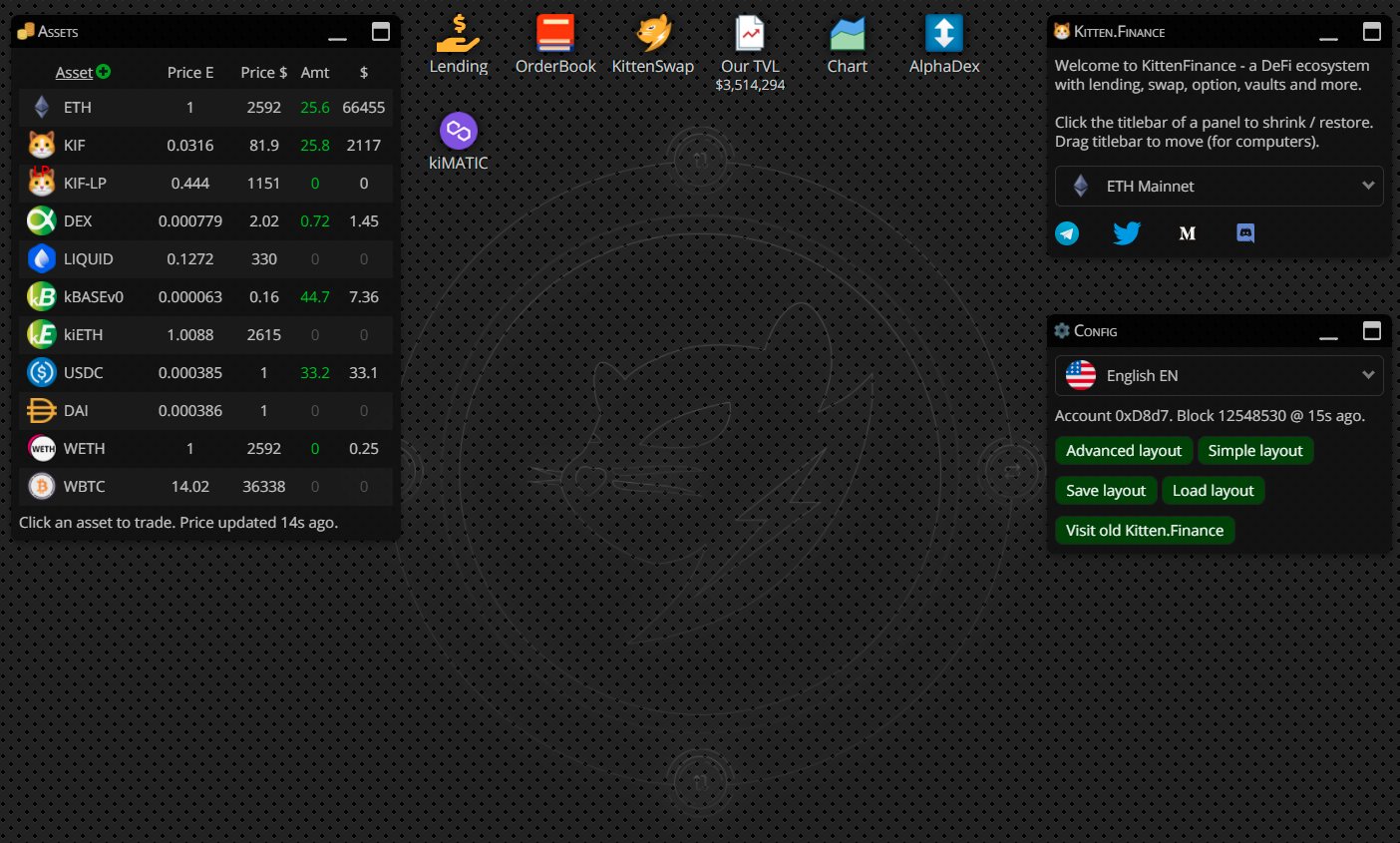

Kitten.finance is a DeFi ecosystem, with our own designs of lending, swap, option and more. Read our Medium for info.

Kitten.finance aims to provide volatility surfaces and yield curves for all smart contracts and DApps.

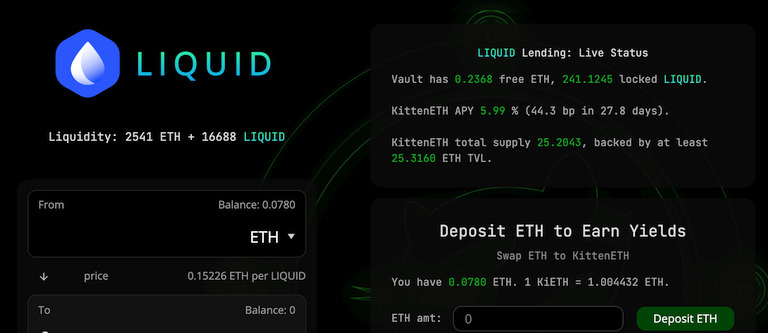

KittenSwap - LIQUID

LIQUID has deep virtual liquidity, and it is our first example of IKO - Initial KittenSwap Offering.

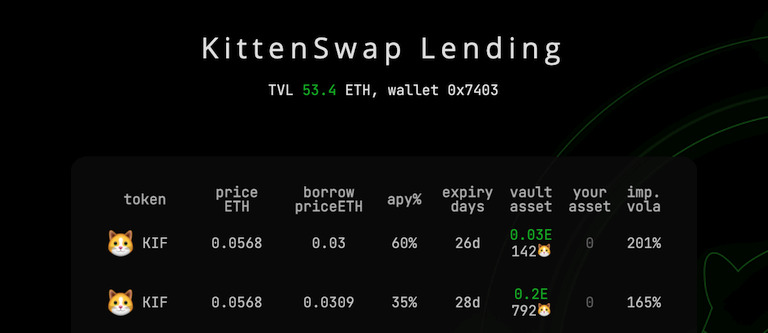

KittenSwap - Lending for all tokens

In KittenSwap lending, you can borrow ETH using any ERC20. Feel free to create lending vaults for your favorite token.

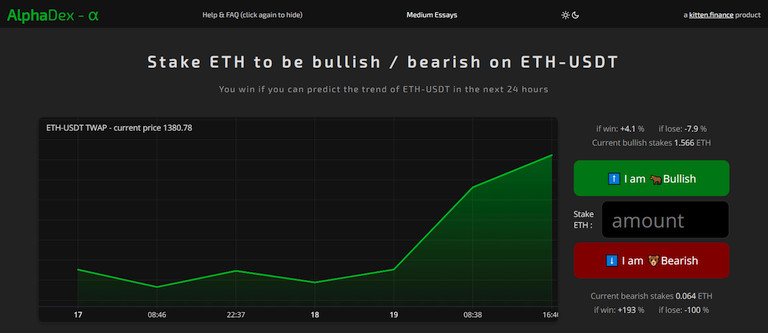

AlphaDex - Enhancing all swaps

AlphaDex is a derivative market and liquidity aggregator, providing advanced trading methods for KittenSwap, Uniswap etc.

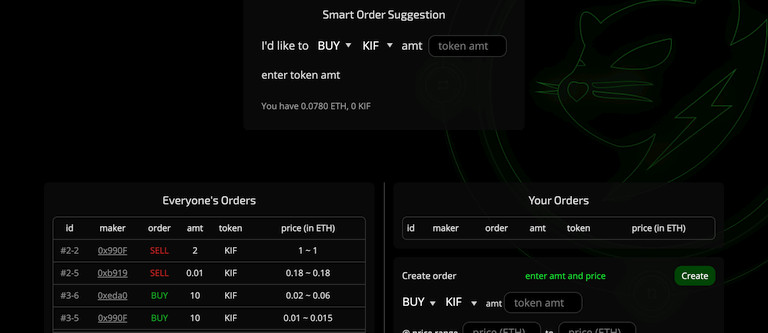

KittenSwap - Wide Limit Order

Wide Limit Order can cover a price range and automatically change its price. Uniswap v3 has similar designs after our release.

Base currency of Kitten.finance

- An elastic supply token which can be rebased towards $1.

- Will be 1-1 migrated to a stable coin kBASE which can be minted on KS by locking assets as collaterals.

- Stake kB for tokens of future projects.

Utility token of AlphaDex

- Max supply is fixed at 420000.

- Dividends & buybacks from AlphaDex.

- Privileges on AD such as fee reductions.

- Voting for AlphaDex changes.

- Stake DEX for tokens of future projects.

Flagship token of Kitten.finance

- Max supply is fixed at 42000.

- For the DAO governing Kitten.finance.

- Dividends & buybacks from KittenSwap (including its lending & vault functions).

- Stake to open new markets on KS.

- Stake KIF for tokens of future projects.

Suggestions for newcomers:

- Buy KIF from Uniswap.

- Stake KIF in pool 101 for kBASEv0.

- Stake kBASEv0 in pool 203 for DEX.

- Stake DEX in pool 205 for more DEX.

Become a LP for higher yields:

| pool | apy % | your stake | claimable | uninvested | total pool | weekly | next reduction |

|---|

After a reduction, do a Claim (or Stake) to start the emission of the next round. We just need one person to do this for the whole pool.

When you stake kBASEv0 into pool 203, it will be automatically converted to nkB (norm-kBASEv0), which is "the amount of kBASEv0 you will have if the total supply of kBASEv0 is 1M", and hence unaffected by rebases. And the amount of nkB is different from the amount of kBASEv0, because the total supply of kBASEv0 is different from 1M. When you unstake nkB, it will be automatically converted back to kBASEv0.

An example: [assume kB total supply = 3M] => [you deposit 3000 kB, and becomes 1000 nkB] => [kB rebased to 4M total supply, and nkB is unaffected] => [however if you unstake 1000 nkB now, it becomes 4000 kB]. Hence your kB is rebased correctly.

[kBASEv0 REBASE (can call between XX:00:00 ~ XX:02:59 every hour)] [kBASEv0 contract] [kBASEv0 chart] [DEX contract] [DEX chart]